How to Make the First Draw on Your New Build Without Any Headaches

You’re a developer who’s just acquired the perfect infill lot in Calgary with the intent on building the next trendy duplex or 4-plex. With land purchase contract in hand, you are excited about the doors of opportunity that have just opened up. And as quickly as that excitement has set in, a headache of financials flood in from the other direction.

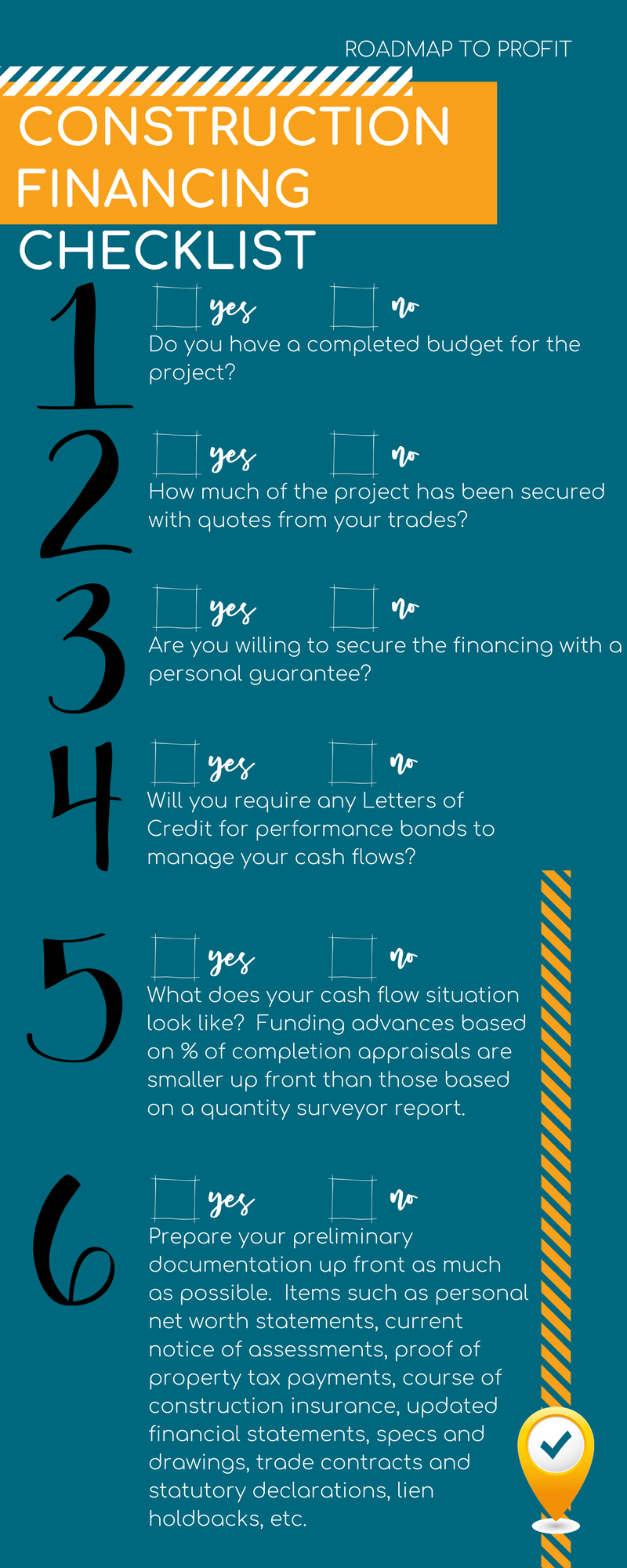

You still need to figure out who will handle the financing of this project and you need to make sure that you are able to close on the lot by the purchase closing date. Typically, that can be secured by a mortgage either in your personal name or that of your company, but deciding on the type of mortgage and the amount of interest you are willing to pay is closely tied to the amount of your own personal equity you can put into the land cost yourself. The less money you invest, the higher the interest you are going to have to pay. You also need to arrange for that all-important construction financing. Here are some important steps to consider when arranging for construction financing on a multi-family building:

A common situation that I run into is that the project gets underway with all the soft costs (architectural design work, development permits etc) before the heavy lifting work is done to secure the loan. As the project gets to foundation stage, the developer is left wondering why their first draw from the lender is taking so long.

But the truth is that financing takes time; documents need to be processed, lender and structure types need to be considered, negotiations may need to take place, budgets and cash flow proformas need to be prepared as well as a detailed construction schedule. Finding the right balance between the amount of interest to pay, the amount of paperwork involved in each draw request, and the amount of due diligence required from you the developer or outside investors need to be considered.

This post is particularly timely as I have recently dealt with two related situations in the last month.

As a builder/developer, you need to be aware of all the terms and conditions of your financing contract with your lender. Try to do most of the prep work up front to save yourself some time on the first draw (which always takes the longest).

Having a great performing accounting department can save you both time and money in this regard. For more information on how your accounting team can make this as smooth and painless as possible, please refer to my Profit Academy Training Course.